Taxes arent the problem, new debt is the problem. Raise all the taxes you want, spending will just increase to make it as if you never raised taxes. Hell...we pay more right now just in interest on the national debt than we receive in ALL of our income tax revenues. Thats right, if we had never gone into debt, we could do away with income tax.

You have to take away the power to print money out of buttholes. If you give ANY human being or group of human beings the power to PRINT MONEY OUT OF THEIR ASS the results can NEVER be good.

Fiat currency always fails. Name one that hasnt. And dont try to name a modern currency, because I think all modern currencies have already proven to be failures. (actually every currency proves to be a failure given enough time)

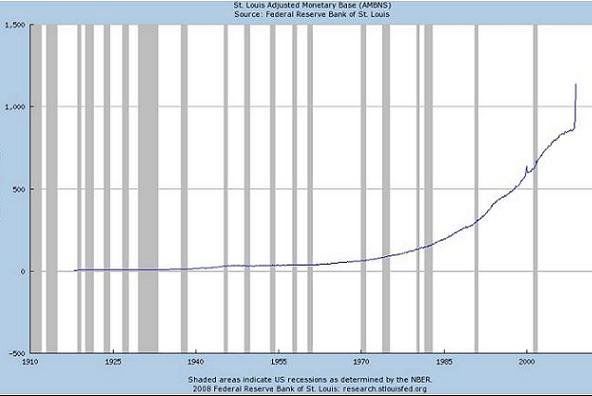

Heres Americas inflation since 1900. Gee....what happened in the 60s/70s that caused such a big jump? Hmmmm....it couldnt be Nixon removing the dollar from the gold standard could it? I mean, I know a lot of economists said inflation would soar if we did that, but they were all proven wrong of course. Nixon was a smart man and TOTALLY trustworthy to do the right thing for America. Nope....the Federal Reserve says inflation is low. 2-3% for the past 25 years or so. Hmmmmmm.....unfortunately even 2% a year means the money halves in value every 35 years. And thats if youre stupid enough to trust the damn Federal Reserve Mafioso and their numbers. The government always calculates inflation without food or energy, which are the two MAIN things people purchase and are the MOST susceptible to inflation. Reporting inflation without food or energy is basically reporting inflation without reporting inflation.

But gold standards and silver standards arent a cure all. Remember, those economies can be destabilized by too much gold/silver. For example, Spain, during the height of their empire was on the gold standard. When they discovered massive amounts of gold in America, they mined every bit they could get out of the ground and put it in circulation. The effect was a rise in prices, just as if you had printed too many dollar bills.

And thus this is the secret of currency management. It doesnt *really* matter in reality if youre backed by gold or by nothing, the truth is, you CANT grow ANY economy too fast or it will be inflationary. How wise is it to go to Vegas and try to double down on red? You cant get rich quick without taking massive risk. For some strange reason I dont think the economy that 300 million people depend on should be taking on massive risk.

Author

Topic: Hyper Inflation is fun! (Read 4297 times)

Author

Topic: Hyper Inflation is fun! (Read 4297 times)