The Global Oil Peak

"Stocks have reached what looks like a permanently high plateau"

-Irving Fisher, economics professor at Yale University, 1929.

Common knowledge is often, frankly, wrong. Common knowledge states that “they” will find a way to keep selling oil, and that the current oil-intensive social structures- everything from manufacturing to farming to suburbs- will work just fine into the future. This ain't, as the song goes, necessarily so.

A number of researchers and industry experts now believe that, taken together, the oil output of all the world's reserves may be nearing the maximum annual production, and that in the near future, annual production of oil will trend downward. Optimists may put this transition point centuries in the future. Pessimists will put this tipping point months in the past.

This article will first briefly explore the history of oil production and the tools and systems used to collect it. It will then introduce Peak Oil Theory and will display the current world oil production situation and where and how the resource is being used.

These facts will allow us to extrapolate a theory of future oil production and the consequences of decreasing oil supply as the demand- the fundamental need for energy- constantly increases.

The most widely-accepted theory of oil formation holds that all of earth's reserves form over millions of years from deposits of organic matter- dead algae and plankton that settles to the bottom of seas and lakes. After being buried by silt and geological movement, these deposits sink into depths of 4 to 6 kilometers, where the pressure and temperature transform the fossilized plankton into various grades of petroleum; the finest “light sweet crude oil” comes from the purest reserves, while oil shales and tar sands from more contaminated deposits. Later processes bring these reserves near the surface; in fact, oil was first collected from surface springs in rich areas.

One the first industrial uses for oil arose in china, where workers, using drill bits attached to bamboo poles, dug for oil that was then burned to boil salt out of seawater. Over the centuries, alchemists and researchers throughout the world began to refine oil and extract useful products such as kerosene and experimental weapons- including reagents used in the production of the long-lost Greek Fire.

The history of the modern oil industry began in the mid-1800s as effective means of refining kerosene from crude oil became available. Demand for kerosene for lighting and heat led to oil exploration throughout the world. great Oil Booms in Russia, the US, Canada, and parts of the mid-east arose in response to the demand. This was only accelerated by the popularization of the automobile, a fad many may still be familiar with. An examination of annual oil production in the US during this early time shows the boom clearly; In 1859, 2,000 barrels of oil where produced in the US. By 1869, 4.2 million barrels where produced, and in 1906, less than 50 years later, 126.5 million barrels where produced from American sources.

By the 1920s, global oil production had started an exponential upward climb that was only interrupted by the 1980's oil glut; this in turn was caused by extreme price inflation due OPEC and OAPEC sanctions and by later disruptions in Iranian oil productions, which both drastically decreased production, and thus increasing the price for oil derivatives. Following this, global production has been increasing at a gradually decreasing rate- the growth of the 1960's and early 70's is not being repeated.

The oil mining technology of the present day has advanced somewhat from the bamboo drills of the ancient Chinese. Before the bit even touches the ground though, an oil deposit needs to be found. Once located, the oil can be exploited, and each deposit, each pool, and each individual well goes through a life-cycle of gradual increase and then dropping off. The oil from each well is then refined and put to use in the global economy.

As mentioned before, oil exploration is the first step in production. This is a largely variable part of the oil production process; one year may see ten times the investment in oil exploration as the previous or next year, as companies respond to trends and fluctuation in the market. This is also highly responsive to technology; advancement in sonar and radar techniques, chemical analysis, and even spaceflight and mapping technologies, can reveal previously hidden reserves.

The graph below displays the growth of oil exploration during the later parts of the 1900s. As one would expect, during times of high prices, discovery increases drastically.

One can clearly see that since the 1960's, only fewer and fewer, or smaller and smaller, discoveries have been made.

Production, of course, cannot keep up with discovery for a number of reasons. First and foremost is the difficulty of obtaining the land and building and digging the wells and supply lines. Some oil reserves may be proven to exist, but be so difficult to tap that it is not economical to do so until prices rise or new technology becomes available. Other externalities can come into play, such as political disturbances, natural disasters, and production control; limiting global supply to increase the price. Some forms of oil reserve simply cannot be extracted perfectly, such as oil shale, which requires roughly 2 barrels of oil to refine every 3 produced. Finally, these discovery estimates can be inflated to increase the apparent value of the field or strength of the oil company.

Currently, average annual production is higher than average annual discovery, meaning that proven untapped reserves (discovered oil minus produced oil) are decreasing rather than increasing as they had up until the 1980's.

Now we get to the whole point of oil mining; the actual oil well. This is, it's self, key to an understanding of the Peak Oil phenomenon. The life-span of any particular well is a flat-topped bell curve. An entire oil field's production is a reflection of the total output of it's component wells, and is a flat bell curve as well. A nation's average domestic oil production will follow the curve of it's field's production, and the global oil production rate appears to be following the same pattern.

The graph below shows the total output of eight hypothetical deposits of varying size.

[Take my word on it, I couldn't find the graph again... this is from my old text file.]

The current global oil market has effects in every element of modern life in every industrial and post-industrial country on earth, and some of the most important producers are geopolitically unstable. Currently, Saudi Arabia has the greatest oil reserves in the world, followed distantly by Canada, Iran, Iraq, Kuwait, the United Arab Emirates, Venezuela, and Russia, in that order. Other than Canada, most of these nations are at least unfriendly with the rest of the world, all the way up to being engulfed in civil war.

The concept of Peak Oil is not an extraordinary one; simply put, all things that go up come back down, and the production of any resource from fixed reserves is no exception. This turning point, whenever it may occur, is the production peak.

Peak Oil refers specifically to this point in oil production. There are, in fact, three “peaks” that can be considered; the peak “quality”oil- that is, the peak production from reserves of light sweet crude oil, which is easiest to refine; the peak “exportable” oil, which subtracts the amount of oil consumed within the oil-exporting countries. Then, there's geological peak, which is the point when 50% of all refinable, accessible oil has been mined and production will trend downward. This last form is the most applicable to the average consumer, and is the focus of this report.

What has made Peak Oil controversial is, in large part, the work of Dr. M. King Hubbert, who applied simple mathematics to an understanding of the structure of oil production and geology to estimate the point when Peak Oil production would occur in the united states. He was considered a radical for his 1956 prediction that US peak oil would occur at some point from 1965 to 1970; The following graph shows the US' annual oil output during that time period:

This astoundingly accurate prediction was part of an article to the American Petroleum Institute. In this article, he also set forth the prediction that world oil production would reach a peak in 2006. In a 1975 interview, he put forth that the actions of OPEC would flatten this curve, but this would have an effect of slowing the arrival of peak by roughly a decade.

Modern experts have revised these predictions, as some elements, particularly the economic slumps of the 1980's and 90's- and the late 00's- has slowed oil demand somewhat more than Hubbert predicted. Trends such as the shift to other forms of fossil fuels for heating, and the improvements of automobile fuel efficiency, have also had an effect on the rate at which oil supplies have been developed; it is important to note that the timing of the peak has not been changed directly due to less oil being used- instead, slightly lower oil demand has encouraged less well development and less exploration than was previously expected.

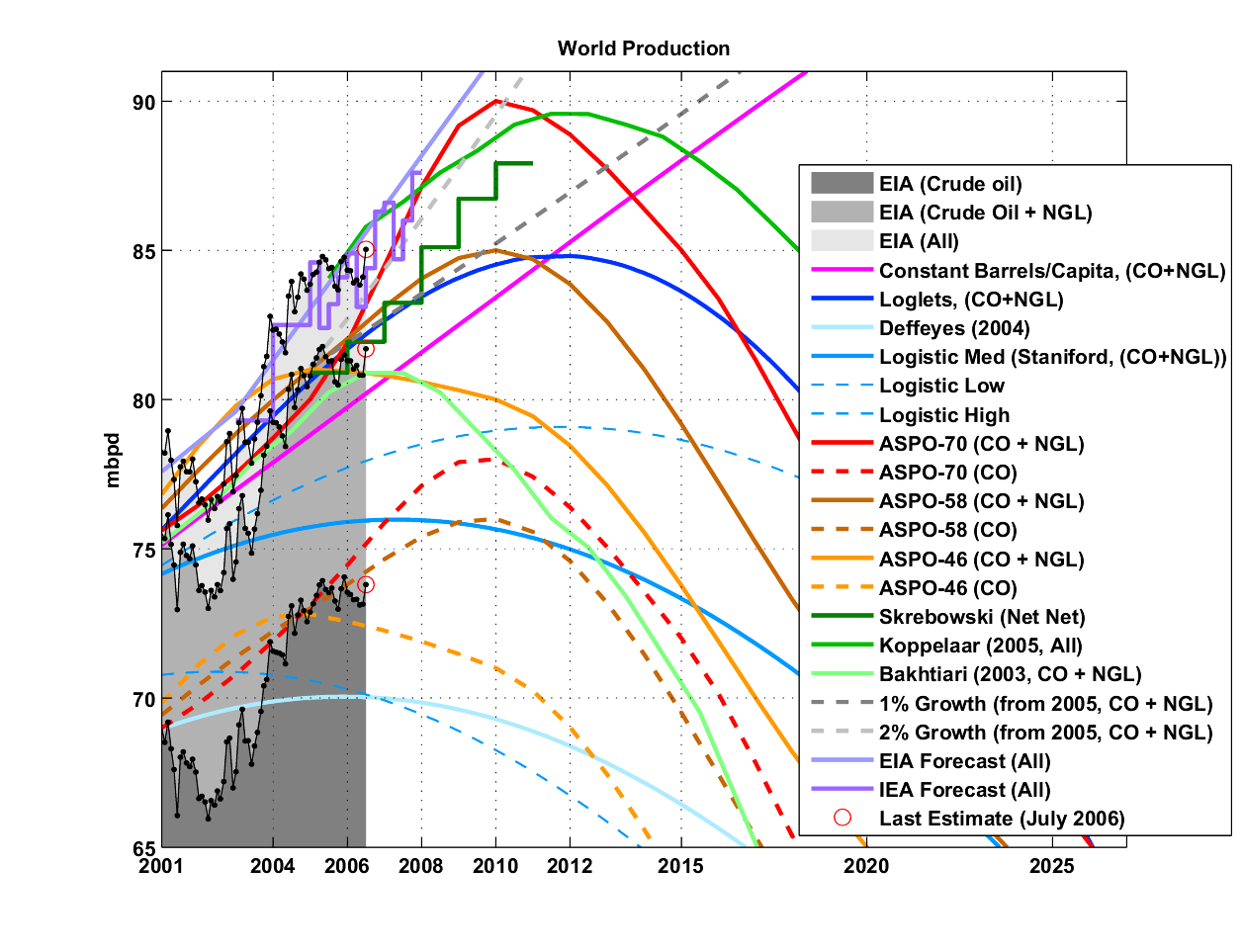

While it would be impossible to prove that global oil production has peaked at any point until perhaps a decade after the fact, there are a number of estimates of when exactly this peak would appear. Hubbert's original prediction of 1995, plus the decade he later adjusted his prediction by, would give us the year 2005. The leadership of Saudi Arabia's national oil company, Aramco, and holder of the majority of the world's proven oil reserves, is divided. Company president Abdullah S. Jum'ah has said that reserves will last more than a century; Sadad Al-Husseini, former vice-president, has previously stated that production would peak in 2015, and more recently claimed that production had already peaked in 2006. Other prognosticators have placed Peak Oil across a gamut, like Atlantis, from having already occurred in 2004, 2006, and late 2008, to 2010, 2012 (some because of the “mystical significance” of 2012 in the Mayan calender. This essay does not consider this relevant), and into 2025 and 2050.

A breakdown of a number of studies is below:

Though varied, the most significant number of available reports have placed the moment of peak oil within the next ten years. After this point, nations such as China and India, as well as the United States and the countries of Europe, and to a lesser extent the rest of the world, will all continue to demand oil in increasing quantities- and production will not be increasing to support it.

In many discussions of peak oil, this is the point where the topic turns to comparisons to the great depression and the dark ages, and to dire warnings of global resource wars and famine. While such claims can be attention-grabbing, they are not exceptionally likely. However, oil's inherent utility as such a dense and portable energy source has made it's use widespread to the point of omnipresence. The gradual but constant increase in price that will follow peak oil will have far-reaching effects that it would be foolish to try to predict in detail. Only on the largest scale can reliable predictions be made, and these can be made with some expectation of success. The basic assumption for the following entries will be that oil supply relative to demand will decrease rapidly following the end of the peak, and that the elasticity of oil demand will be very high at these levels, causing high prices and potential shortages.

Currently, more than half of all oil collected (in some estimates as much as 68%) is used for transportation; partially personal transportation, but mostly cargo transport. This sector also includes air travel. Very importantly, this includes the huge amount of fuel it takes to transport goods overland and overseas. This is followed by various industrial uses of oil, at roughly a quarter of this level. Again, a significant part of this sector is the agricultural industry- things like pesticides and farming equipment. In fact, it is estimated that each American needs 400 gallons of oil per year for the growing of their food alone.

The remaining oil use is mainly in civilian and commercial areas, together totaling roughly 6% of use, and finally electrical generation uses the remainder.

If prices increase and shortages start to appear, the most immediate effect- other than potential stock marker reactions- would be the drastic increase in the price of any items that must be shipped for long distance (that is, nearly everything). More than any other good, foods would be affected, especially those that require refrigeration or quick transport. Even local-grown foods would increase in price due to the fact that so much oil is used in simply growing it. Luckily, small organic farms, which are already low energy-intensity and use much less fuel, will become increasingly competitive.

Air travel is highly sensitive to change in fuel price, and it is possible that some airlines will go out of business, and consumer prices will increase; air travel may, in fact, move out of the reach of many travelers. Long-distance car travel may also see a drastic decrease due to fuel prices, though predicting what price one would see at the pump is a fool's errand. As a result of this, we can expect to see bus and train travel becoming much more popular.

Power generation is one of the most straightforward sectors to predict; as oil prices increase, the attractiveness of other power sources- coal and clean, especially solar, geothermal, and tidal, will increase. The power industry can be considered a microcosm of what we will see happen to a number of industrial uses for oil; Where it cannot be substituted, producers will cut back production.

Though there is no doubt that eventually oil production will peak and then decline, if this point comes in centuries or months is still debated. It is the perspective of this article that neither of these extremes is the true answer. Instead, we will most likely see the effects of energy decline not immediately, but within our lifetimes, if not the next decade- and while we aren't doomed to a dark age, there will be far-reaching effects that we can anticipate and prepare for.

Works Sited:

*Energy Information Association: (

http://www.eia.doe.gov/oil_gas/petroleum/info_glance/petroleum.html)

*Hibbert Peak of Oil Production: (

http://www.hubbertpeak.com/)

*Wikipeda, various articles: (

http://en.wikipedia.org/wiki/Petroleum_industry)

* Omninerd: (

http://www.omninerd.com/articles/What_You_Need_to_Know_about_Peak_Oi)

*Oil Drum, various articles: (

www.theoildrum.com)

Author

Topic: Wrote an essay for economics about Peak Oil (Read 2507 times)

Author

Topic: Wrote an essay for economics about Peak Oil (Read 2507 times)